Those assets are subject to a capital gains tax rate of 28%, 28%, and 25%, respectively. Other assets that have different tax treatment under the capital gains law include section 1202 small business stock, collectibles such as coins and art, and unrecaptured section 1250 gains from selling section 1250 property. In general, this exemption applies if you’ve lived in the home for at least two of the past five years, though it’s important to confirm eligibility requirements via the IRS site or with a tax advisor. Current tax law allows you to sell your home and exempt the first $250,000 of profit (or $500,000 for married couples) from the capital gains tax. Perhaps one of the most important exceptions to the capital gains tax is your primary residence. There are a few types of assets that are treated slightly differently for tax purposes. However, the assets investors most often have to pay capital gains taxes on include investments like stocks, bonds, cryptocurrency, real estate, and more. As a result, if you sell those assets for more than you bought them, you could be on the hook for capital gains taxes. Your home, furniture, vehicles, investment holdings, and other belongings are all capital assets. Which Assets Qualify for the Capital Gains Tax?Ĭapital gains taxes can apply to any capital asset, which includes nearly everything you own for personal or investment purposes. Tax Rateīelow are the long-term capital gains tax brackets for 2022. Below are the long-term capital gains tax brackets for 2021. Rather than being taxed at your ordinary income rate, they are taxed at a rate of either 0%, 15%, or 20% depending on your household income. Under current tax law, long-term capital gains have more favorable tax treatment. Going back to those 100 shares of stock in our previous example: if you held them for 13 months instead of selling them after nine months, your capital gain should be taxed at the preferential long-term capital gains rate. Tax RateĪ long-term capital gain occurs when you sell an asset at a profit that you’ve held for greater than one year. Below you can find the 2022 short-term capital gains tax brackets. As a result, the short-term capital gains rates for 2022 look slightly different than those for 2021. Tax brackets change slightly from year to year as the cost of living increases. Below are the short-term capital gains tax brackets for 2021. The higher your household income, the higher your short-term capital gains rate. Short-term capital gains are generally taxed as ordinary income, meaning at a rate somewhere between 10% and 37%.

Because you held the shares for less than one year, you would have incurred a short-term capital gain. For example, suppose you bought 100 shares of stock for $25, and nine months later sold them for $30 each. Short-Term Capital GainsĪ short-term capital gain occurs when you hold an asset for one year or less from purchase and then sell it for a profit. The category your gains fall into will help determine how much you’ll pay in taxes. To talk about the different capital gains tax rates, we first must discuss the difference between short-term and long-term capital gains. This factor determines whether you pay short-term or long-term capital gains taxes, which also affects the rate you’ll pay.

#STOCK PROFIT CALCULATOR SIMPLE HOW TO#

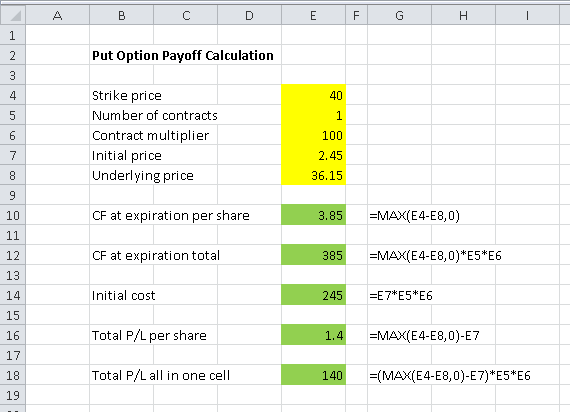

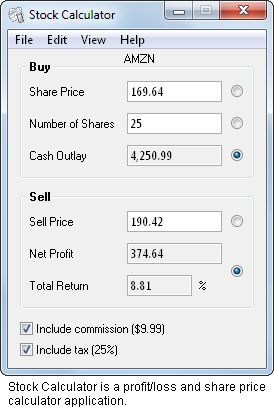

Here’s how to use our tool to estimate how much capital gains tax you might owe: How Do You Calculate the Capital Gains Tax?Ī simple way to estimate your capital gains taxes is to use our capital gains calculator. This simple calculator can help you estimate how much you might owe in capital gains taxes so you’ll be prepared for tax season. To help make things simpler for you, we’ve created a capital gains calculator. When an asset is sold for a profit in a taxable account, capital gains tax is incurred.Ĭapital gains taxes can be a confusing and often unforeseen component of investing. A capital gain is the increase or appreciation in an asset’s value and is realized when the capital asset is sold.

One of the more common taxes that investors pay is the capital gains tax. As an investor, it’s important to understand the taxes you may be subject to because of your investments.

0 kommentar(er)

0 kommentar(er)